Your Guide to Growing Your Business

All of the topics that will give you the edge when it comes to scaling your business and taking it to the next level.

Latest in Growing a Business: Advice, Tips and Resources to Help You Take Your Business to the Next Level

See All Latest

CRM workflows can help automate key sales, marketing and customer services tasks. Here is how to create them.

Consumerization of IT refers to the increased use of employee-owned tech devices and consumer-driven online services in the workplace.

CRM dashboards offer instant insights into the metrics that matter most to your success. Here is what your dashboard should include.

Monetary policy determines the amount of money that flows through the economy. Learn how it affects your business.

Biometric time and attendance systems use fingerprint, facial, palm or iris scans. Learn the laws you must follow to use them for your employees.

Learn the difference between gross and net revenue, which are both important metrics for businesses to track.

CRM software offers numerous benefits for your lead management process. Learn about the main ones and how to get them.

Predatory lending practices include loan flipping, hidden fees and balloon payments. Fortunately, there are laws that protect borrowers.

Learn what information to include in a payroll report, both to ensure legal compliance and to improve financial management.

Learn why profit margins are important to your business and how to maximize them.

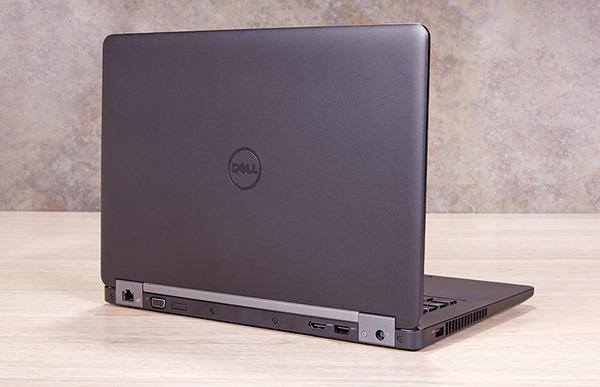

Learn how to buy a secure business laptop – and some key features to protect both the laptop and its contents.

Accounting ratios and formulas streamline the bookkeeping process and help you evaluate your company's finances. Learn how these ratios and formulas work.

Balance sheets and income statements are related but not the same. Learning the difference and when to use each can aid your business’s financial health.

Cash flow is critically important to a small business’s survival and success. These cash flow strategies can help you ensure your business has the cash on hand it needs to grow and succeed.

This guide describes eight accounting methods small businesses can use to manage their finances.

As cash payments decline and contactless payments grow, not accepting credit cards could hurt your business. Learn why your business should accept cards.

This guide identifies common business liabilities that every small business owner should keep track of and understand.

Business owners should understand the basics of accounting, including what accountants do. Learn how to improve your fundamental accounting knowledge.

A competitive compensation plan provides desirable direct and indirect compensation types. Learn how to develop a fair, competitive compensation plan.

Encryption protects the data on your computer and networks. Here's why it's necessary – and how to easily achieve it.

Ransomware attacks have become more frequent and costly since 2019. Is your business protected with proper cybersecurity best practices?

Find out exactly what business email compromise scams are, how to prevent them and what to do if you're targeted.

These apps are faster than email and more secure than texting.

This guide explains what a CTO is and their regular responsibilities in a typical business organization.

Many small businesses fall victim to credit card processing scams. Learn about common credit card processing scams and how to find a credit card processor.

Follow these tips to get a better deal with your credit card processor.

Ignoring credit card security risks leaves businesses vulnerable to stolen data, lost money and fines. Learn to spot and stop credit card security risks.

Learn the basics of credit card processing, including fees, transaction types, and pros and cons.

An income statement can be used for gauging the health of a business and making strategic decisions. This guide explains how to prepare an income statement

Insurance verification helps you determine before a patient's appointment whether their insurance will cover their visit, saving you time and money.